Have you ever received a message claiming to be from your bank, informing you about a hold on your account that will be lifted after clicking to verify your details? How about a text message telling you there were challenges delivering an unknown shipment because of incomplete details?

Those texts are likely smishing scams and if you’re not careful, such messages could cost you your identity and savings. Smishing attacks aren’t new, but criminals have been using this social engineering method more in recent times to target unsuspecting victims. Be vigilant.

What is a Smishing scam?

Smishing scams involve the use of text messages or other short message systems to trick an individual into providing sensitive data by falsely claiming to be from a legitimate business.

How does the Smishing scam work?

- The fraudster sends a text/ SMS to the customer.

- The text contains a link which the customer must click because of an ‘emergency’ with their bank account or credit card.

- When the customer clicks the link, it takes them to a webpage that looks like a legitimate business website. It will ask for sensitive information such as the customer’s username, password, 16-digit credit card number, expiration date, or other details. After this information is entered, the customer will receive an error message.

- This information is transmitted to the fraudster, who then uses it to take over your credit card or account, depending on the information you provide to the fraudster.

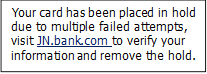

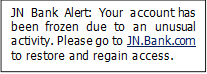

What does a smishing text look like?

JN Bank will never send you these texts, so if you see these messages, DO NOT CLICK the links.

Have you also seen this text recently?

“Jamaica Post: 2/2 There have been 2 delivery attempts, but delivery failed due to insufficient address information. Please confirm your details; otherwise, your shipment will be returned.

Activation link:https://jamaicapostjmsa.icu/9nkC8z

(Please respond with Y, then close the text message and reopen it to activate the link, or copy the link and open it in your Safari browser. Alternatively, respond with T to return the package to the seller.)”

DO NOT CLICK.

Here are a few things you can practise to protect yourself from smishing attacks.

- Do not respond: The easiest way to avoid being a victim is to do nothing. If you don’t respond, a malicious text cannot harm you. Smishers rely on your curiosity and anxiety to execute their attacks, but you can refuse to engage with their messages.

- Slow down: Scammers usually come with a sense of urgency, but don’t feel pressured by any instructions in texts. Approach urgent account updates and limited time offers as caution signs of possible smishing. Always verify before proceeding. Also, check the phone number and match it against those usually listed in official channels.

- Avoid using any links or contact info in the message: Always use official channels to conduct your business and contact with a business or merchant.

- never request you to provide your sensitive information via text. Any notice can be verified directly via an official phone helpline.

- Use multi-factor authentication (MFA) also known as two-factor authentication (2FA): Enabling MFA gives a second layer of protection to your accounts and may keep attackers away, even if your passwords were exposed. Consider using third party applications such as Google Authenticator as a second key to protect your accounts.

What to do if you become a victim of Smishing

If you fall victim to a smishing attack, there are actions to take to limit any damage to your accounts.

- Report all suspected attacks to designated institutions that could help.

- Freeze your cards.

- Change your passwords and PINs, where necessary.

- Monitor your accounts for suspicious activities.

How to report a smishing scam to JN Bank

JN Bank will never ask you for account password/ PINs or all 16 digits of your credit card with the expiry date.

If you receive a suspicious text, contact our JN Bank Member Care Centre at:

- 888-438-5627, 888-991-4065/6 (Toll-free)

- 876-906-5343, 876-926-1344, 876-618-0188, 876-619-2810 (from Jamaica)

- 1-800-462-9003 (from USA & Canada)

- 0-800-328-0387 (from the UK)

Or send us an email at helpdesk@jnbank.com

Safe Banking Tip

Always follow your bank cards. If you visit the gas station or the supermarket, keep a close watch on your cards because they could be skimmed when you’re not looking. Never let a gas attendant or a cashier walk off with your card. Rather, offer to walk with them to the available point of sale terminal to conduct your transaction safely.